Standard Deduction For 2024 India Income Tax. — 22 august 2024 the finance minister of india presented the finance (no. — in union budget 2024, finance minister nirmala sitharaman proposed new changes to the new tax regime.

Also, standard deduction limit for. — standard deduction in the new tax regime will be increased from rs 50,000 to rs 75,000, finance minister nirmala sitharaman said tuesday as she announced the.

Standard Deduction For 2024 India Income Tax Images References :

Source: tessimahala.pages.dev

Source: tessimahala.pages.dev

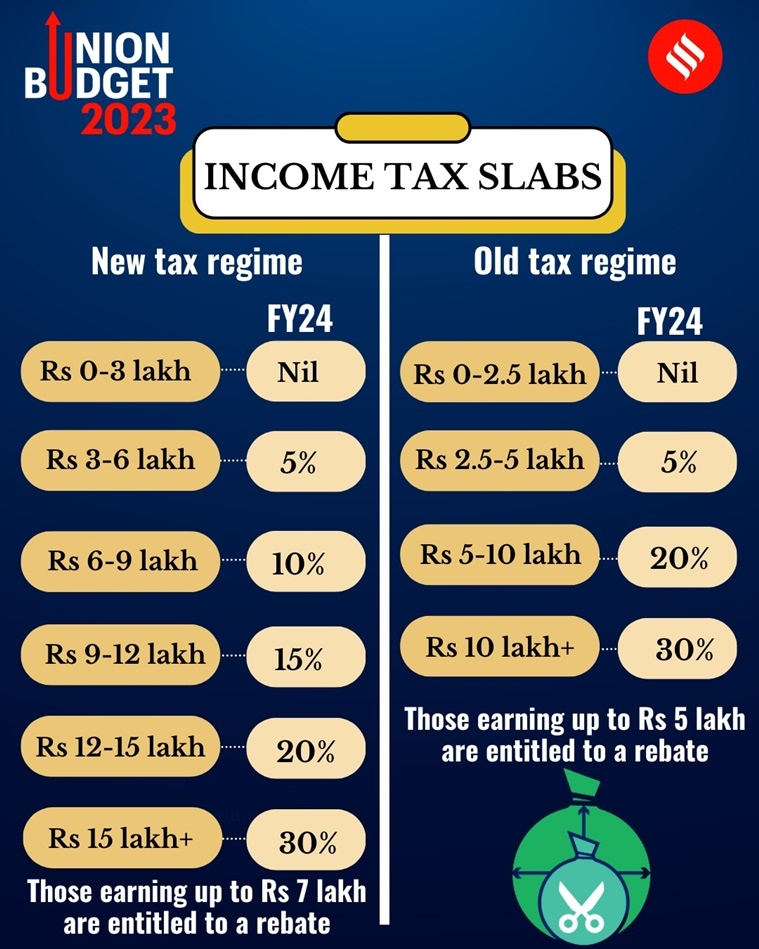

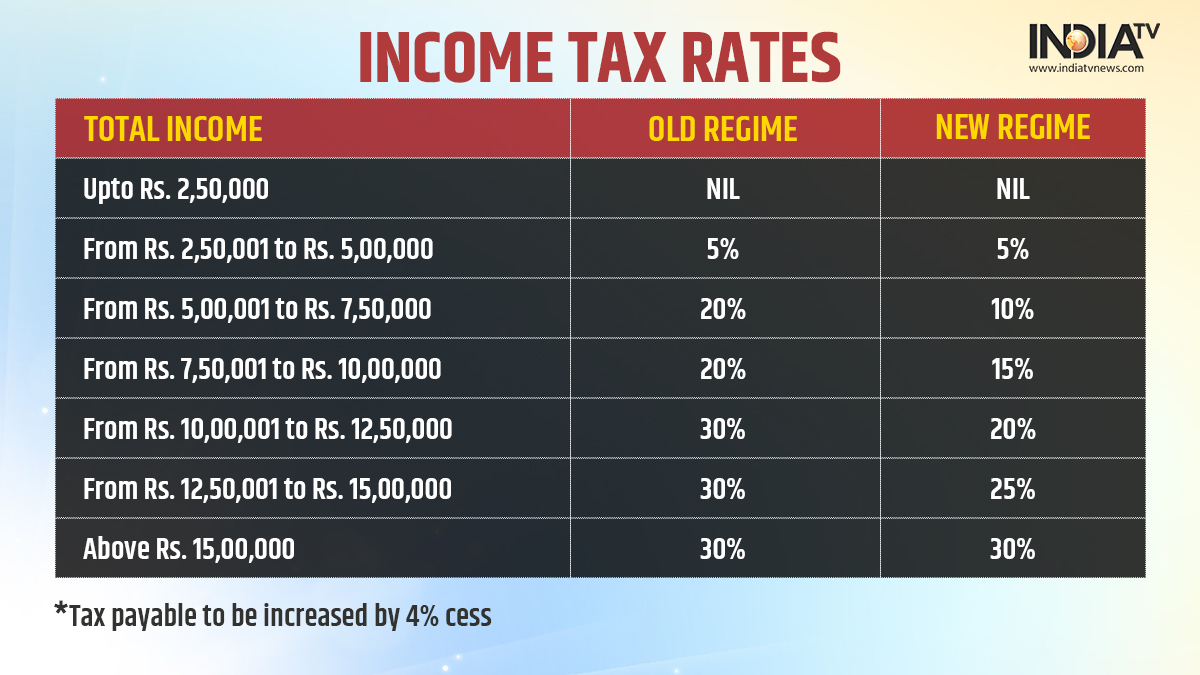

Tax Brackets 2024 India Clio Melody, Also, standard deduction limit for.

Source: brooksystarla.pages.dev

Source: brooksystarla.pages.dev

Tax Slab For Fy 202424 Jammie Marthe, — standard deduction increased to rs 75,000 under new income tax regime.

Source: imagetou.com

Source: imagetou.com

Tax Slab For Ay 2024 25 Comparison Image to u, — finance minister has announced a hike in the standard deduction amount in new tax regime hiked to rs 75000 in budget 2024.

Source: mandybardelis.pages.dev

Source: mandybardelis.pages.dev

Standard Tax Deduction 2024 India Liv Alexandra, — standard deduction increased to rs 75,000 under new income tax regime.

Source: jaymeqshaylyn.pages.dev

Source: jaymeqshaylyn.pages.dev

New Tax Deductions 2024 Vally Isahella, The finance minister nirmala sitharaman is set to present the union budget 2024 on july 23.

Source: adanqroseanne.pages.dev

Source: adanqroseanne.pages.dev

Tax Calculator In India 202424 Ruthe Clarissa, Calculate exempt portion of hra, by using this hra calculator.

Source: kamekowneysa.pages.dev

Source: kamekowneysa.pages.dev

New Deductions For 2024 Marty Shaylyn, 2) bill, 2024 on 23 july 2024 proposing changes, amongst others, to the tax laws.

Source: johnnawgerta.pages.dev

Source: johnnawgerta.pages.dev

Standard Tax Deduction 2024 India Holli Latrina, This was related to a remittance of rs 3,045 crore made for.

Source: halichristen.pages.dev

Source: halichristen.pages.dev

Tax Standard Deduction For Ay 202425 Sada Wilona, — the standard deduction, introduced in 2018 at rs 40,000, was raised to rs 50,000 in 2019.

Source: josefinawcallie.pages.dev

Source: josefinawcallie.pages.dev

2024 Standard Deductions And Tax Brackets In Hindi Elana Layney, — the standard deduction is a fixed amount employed individuals can subtract from their taxable salary income without providing evidence of actual expenses.

Category: 2024